How often are you required to pay Body Corporate levies, and what happens if you don’t pay on time?

Owning a property in a Strata complex means that when you buy into this situation, you’re making a commitment to make Body Corporate levy payments on time, so that essential administrative and maintenance work can be undertaken, and the value of your investment maintained. You have no choice.

Administration of Body Corporate levy payments

So let’s address who’s responsible for what.

As discussed in detail in our earlier article What Happens to the Money You Pay for Body Corporate Fees, your Scheme’s budget is determined by the Body Corporate Committee (not your Body Corporate Manager) and presented at the Annual General Meeting each year for approval by lot owners.

Once approved, the levies are paid to the Body Corporate account. In many cases the levies are collected by the Body Corporate Manager on their invoicing system on behalf of the Body Corporate.

A well organised Body Corporate Manager will provide new lot owners with the a “welcome pack” which outlines the Body Corporate policy on payment of levies, and provide a range of options to make payment easy.

At Tower Body Corporate We make it easy by providing every Lot Owner with online access to Strata Pay through our website.

How do you know how much you need to pay, and when?

In Qld, the law states that the Body Corporate must give each Lot Owner written notice of the contributions they owe. This notice must be given at least 30 days before a contribution is due.

The contribution notice must include:

- The amount owing

- The due date

- Any discount that can apply

- Any penalty if the payment is overdue

- Any previous payments that are overdue.

At Tower Body Corporate we take care of this for all the Schemes we manage, so that every Lot Owner has plenty of advanced notice.

Depending on the financial structure of your Body Corporate, levy periods and amounts are listed in the AGM minutes, and levy notices will be issued 2, 3, or 4 times a year and are usually due on the first day of the levy period.

How do you pay?

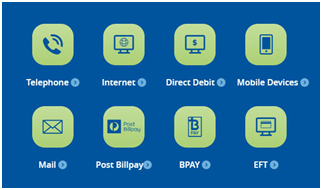

We make it easy by providing every Lot Owner with online access to Strata Pay through our website. Lot owners are provided with a unique code, and after login can choose to pay up to 8 different ways.

Full financial records and BC meeting minutes, can be accessed by Lot Owners at any time through our online access to Strata Max.

What happens if you don’t pay on time?

It’s important that levies are paid on time, so that the Body Corporate can continue to fulfil statutory requirements, undertake necessary maintenance work and pay its bills on time.

Lot owners who are in arrears will receive a reminder letter from us, and then maybe a second reminder letter, then a final letter of demand.

We also understand that sometimes there are circumstances that prevent the Lot Owner from paying on time, so a courtesy phone call will be made to try and understand why the lot owner has not paid the levies.

Are there financial penalties?

Yes there are. In addition to the outstanding levies, you may also receive a 30% simple interest per annum charge. The legislation specifically allows the Body Corporate to charge this to each and every levy that’s outstanding. This can very quickly mount up if it’s applied on a monthly basis, to each over due levy payment.

Can a Body Corporate take legal action for overdue fees?

Yes it can, and has up to three and half years to commence recovery of outstanding levies. Note: In October 2017 it was ruled by a Queensland District Court Judge that a body corporate must commence legal recovery of outstanding levies within two years and two months, however an appeal by the District Court in July 2018 saw this overturned by the Court of Appeal, so that Bodies Corporate have up to three and a half years to commence recover.

In addition, that individual lot owner will become responsible for all the costs, including the Body Corporate Manager’s cost relating to expenses and outlays, and any expenses and outlays of the Body Corporate, including any legal fees.

How we can help

We take overdue levy payments very seriously at Tower Body Corporate, because it affects all Lot Owners, in many ways. Body Corporates are like not-for-profit organisations – the levies are the only form of finance available to fund necessary expenses.

- The process and body corporate debt recovery systems we use have proven to be consistently effective in recovering overdue levies.

- Many of our clients have told us of the positive change in financial circumstances that our team has made within the first few months of taking over body corporate management of their building.

- Body corporate fee recovery is governed by strict legislation, and our processes and systems are fully compliant with requirements.

Contact Tower Body Corporate today for a confidential discussion about the financial administration of your Scheme Or for other body corporate services in Gold Coast & Brisbane. We’d be happy to help.

11 replies on “What are the options for paying your body corporate levies?”

Do body corporation need to supply evidence before issuing an owner with a fine for a breach ie noise , working on projects at weekend not just hearsay

The body corporate cannot issue a fine for a breach of by-law so if you have received one there may be an issue. It can issue a breach of by-law notice and there should be some evidence of this. In the case of noise a verbal report may be sufficient. Construction noise at the weekend is also a council issue and you can check your local website for rules around when you can make noise.

Do body corporation need to supply evidence before issuing an owner with a fine for a breach ie noise , working on projects at weekend not just hearsay from an other owner. ??

Body Corp gone up significantly I live on disability pension have organised payment plan now being Slugged another $66 for plan which is a piece of paper they simply print out. I do not think I should pay the $66 extra what are my options. In that summation the plan does not help it’s similar to a late fee

Hi,

The best thing to do is contact your body corporate manager and committee and try to explain your situation to them and see if something can be worked out. Otherwise, you may need to look another ways you could raise extra finance. That probably sounds hard but there are no easy answers here. Body corporates have a range of mandatory expenses that are increasing. The money for this comes from owners. If you are struggling to pay that it’s a very onerous position but one that has to be faced.

Does a body corporate manager need to supply an invoice to each unit owner with an ABN number etc on it. I’m thinking our guy is a bit dodgy and won’t send me one with all the relevant information on it.

Thanks

As per the BCCM website a levy notice must be given at least 30 days before a contribution is due and include:

– the amount owing

– the due date

– any discount that can apply

– any penalty if the payment is overdue

– any previous payments that are overdue.

I don’t think there is a requirement to list the ABN of the Body Corporate although it will have one.

Most levies are processed through a third-party payments agency – usually, Stratapay or Deft – and have extended details about how payment can be made.

The fact that you are asking the question about the validity of the notice raises something of a red flag – it’s not the kind of thing body corporate companies want to ask questions about. Maybe see how other owners feel but trustworthiness and transparency when it comes to financials should be a minimum standard.

I’m living in cairns area my body corporate are 4400 but for August body corporate asking for over 8000 I’m not happy and l think that l shouldn’t pay this much what can l do lm pensioners and l can not afford that My 6 month pension will go for body corporate and council 2200 how people like me can complain about this?

Hi,

there can be many reasons why your levies might have increased – most likely to find necessary works at the complex. You should have been updated on this in meeting minutes and would have had the opportunity to vote on the matter. Contact your body corporate manager or committee and ask the reasons why.In terms of payment you are legally obliged to pay a correctly raised debtagainst your lot. If you can’t afford to pay contact your body corporate and see if you can agree a payment plan.

Can one arrange to have instalments effected by direct debit?

Hi Tony,

Tower Body Corporate work with a company called Stratapay to issue and process levies. The notices list seven different ways of paying including direct debit. You can find the details for this on the levy notice. If you are not with Tower and your management agency doesn’t offer this facility you might want to contact your agent to discuss the payment options.

Thanks,

Will