Premium costs have risen fifty percent over a four-year period

September saw the release of a major new report into insurance cover for the body corporate industry.

It is the first substantial investigation of its kind and adds some valuable insight into a key part of the management of body corporate sites.

For many people, there is a perception that the body corporate industry is big business and, to some extent it is; the national strata sector has an insured value of nearly $1 trillion and provides over 9000 direct jobs with millions of other casual jobs in the form of contractor appointments.

However, the day-to-day reality is that the business is still something of a fast developing cottage industry made up of multiple small players interacting to assist owners. Research and data about the operation of body corporates remain thin on the ground, so when a large scale investigation is undertaken the findings help push future development forward.

From an owner’s perspective, the main question with insurance tends to be around costs and the renewal premium typically represents the largest line item on most budgets. Most people are aware that premiums are on the rise and people see the increases at renewal time each year but don’t always understand the bigger picture by which these numbers are derived. Too often the end result is misunderstanding and frustration.

The report, by researchers from Deakin University, now provides some hard numbers to support generally held perceptions and those, in turn, will help owners and managers work out how to better control some of the problems being faced.

Perhaps the key finding is that the rise in premiums is now quantified: the average total cost of body corporate insurance nationwide increased from $4320 in 2016 to $6522 in 2020.

That’s a fifty per cent rise over four years increase that has had to be factored into every body corporate budget. If you are wondering why your levies are increasing, it’s a big reason why.

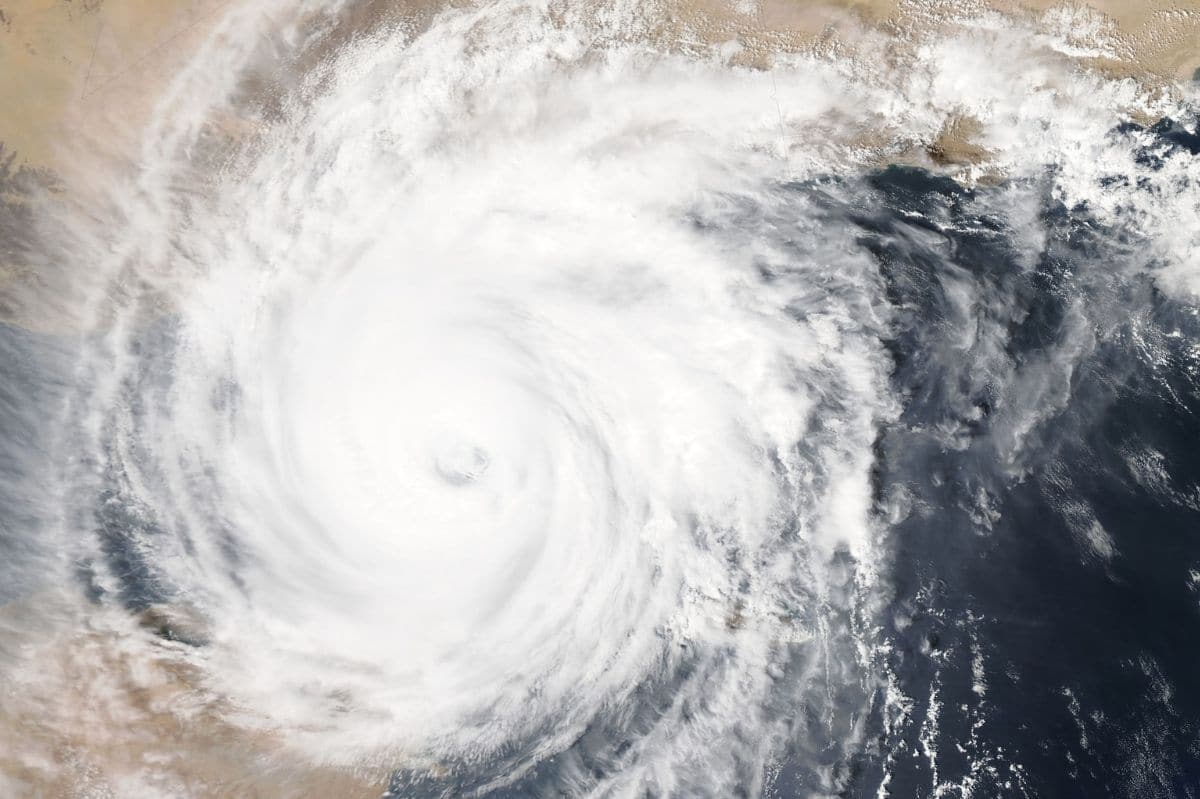

There is a wide range of global and local factors impacting insurance affordability which put some of the many cost increases outside of the control of individual body corporates. Still, if you want to know what insurers are worried about, take a look at what claims they are paying out for.

Between 2016 and 2020 the costliest claims were for:

- Storm damage – $438 million

- Water damage – $362 million

- Fire damage – $249 million

- Burst water pipes – $160 million

If your building is vulnerable to any of these, then it’s likely your insurer is rating your risk accordingly. And, if you think that these things may be a concern for your building then you should ask what you can do about them. For example, no one can stop the net big storm coming in but you can make sure that your pumps in your building have been serviced so that they can handle any issues. When you think about water damage you might start by asking when the last time your roof and gutters were checked and cleaned. Maybe it is time to have the window seals in your building checked and repaired. Fixing a small issue today could save a big cost down the line.

The research also took a look at the impact of payments received by body corporate management companies for the work they do arranging insurance and how these change the picture. This can be a controversial subject and, for full disclosure, Tower does receive commissions where it is involved in placing the insurance for a building we manage.

The payments work in a similar way to a travel agents commission for booking a holiday and when lot owners were surveyed about the commissions some 40 per cent thought they should be abolished. Fair enough, but the picture changed a little when alternative remuneration models were brought into the equation. When asked if they would agree to an increased service fee if commissions were removed the majority of owners who were opposed to commission based remuneration changed their position.

What many owners won’t know is the volume of work that goes into arranging insurance matters for customers. Here the report identified 47 strata services that are regularly provided by body corporate managers for their clients. We won’t list them all, but it is reasonable to say that a large amount of work is being done in exchange for the compensation received.

What was clear from the report is that many people felt there was a lack of transparency around how the body corporate insurance system worked and what the options were for owners. The emphasis on correcting this lies with body corporate managers who the reported identified as poorly articulating insurance matters.

At Tower, we value the quality and transparency of the information we provide so hopefully this article is a small step toward rectifying that and for anyone who wants more detailed information please contact your manager.

_____________________________________________

If you would like to know more you can download the report here: A data-driven holistic understanding of strata insurance in Australia and New Zealand

There is also a nice article about it on the Look Up Strata website: Valuable Data and Insights Revealed in New Strata Insurance Report

If you have any questions about insurance at your scheme speak to your manager:

Tammy Lynch: tammy.lynch@towerbodycorporate.com.au P: 0466 156 765

Samantha Morrison: samantha.morrison@towerbodycorporate.com.au P: 0434 670 058

Kelly Borell: Kelly.borell@towerbodycorporate.com.au P: 0435 766 852

Will Marquand: will.marquand@towerbodycorporate.com.au P: 0427 125 656